Introduction to 5G

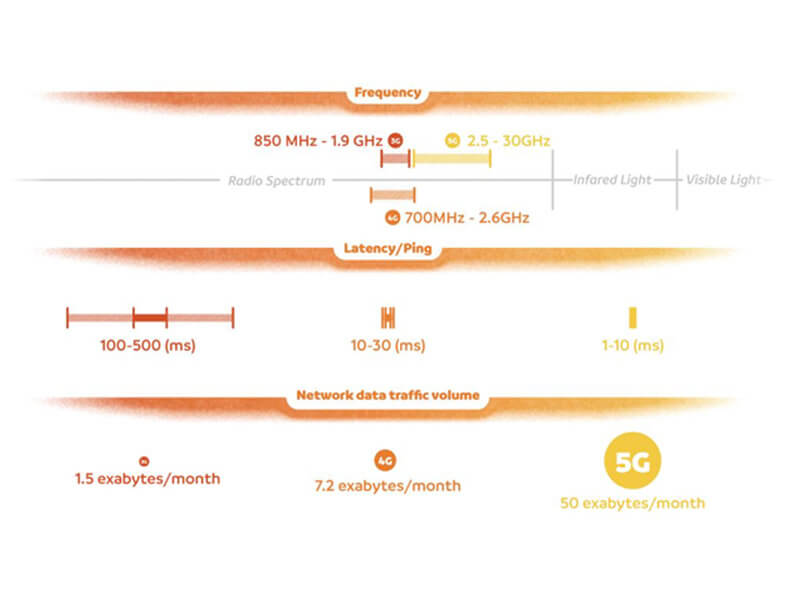

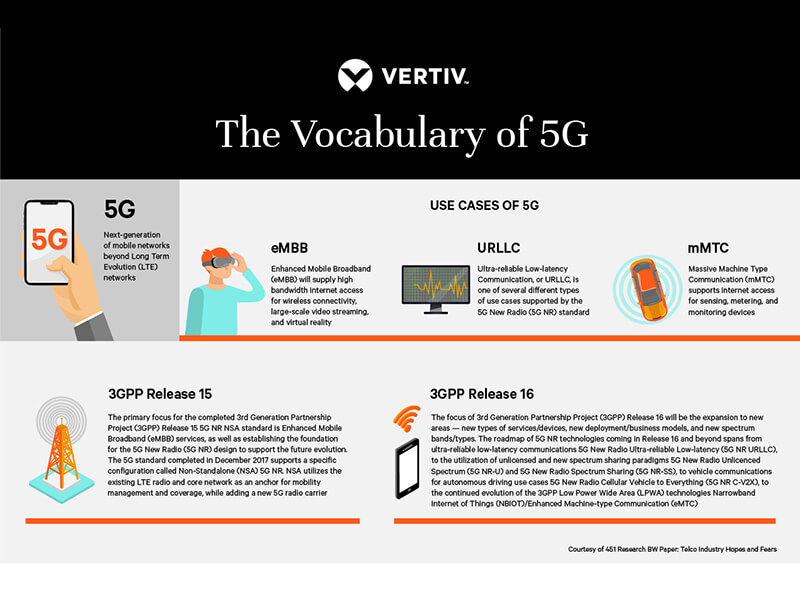

5G is the fifth generation of the cellular telecommunications network, delivering increased bandwidth and faster speeds that enable everything from high-definition video to ultra-low-latency gaming and advanced telemedicine, with the promise for even more advanced applications as the technology matures and expands around the globe.

About 40% of the world’s population is expected to have access to 5G by 2024, and 5G is expected to enable $13.1 trillion in sales by 2035. Global 5G capital expenditures (CapEx) and research and development (R&D) are up 10.8% year over year and are projected to reach $265 billion annually over the next 15 years.

The race to 5G is a gold rush, and telecommunications operators are sprinting ahead, prioritizing availability and security in the race to be first. This is understandable, but managing the inevitable increase in energy consumption is a looming challenge.

“5G represents the most impactful and difficult network upgrade ever faced by the telecom industry.”

5G architecture builds on existing networks, but it introduces additional IT systems that enable fast, powerful computing from core to edge. This is the promise of 5G – the ability to process data and perform computing at each site and microsite to enable ultra-low-latency applications for the end user.

This increased reliance on IT presents new challenges and demands some fundamental changes across the network. IT equipment doesn’t fit seamlessly into traditional telco sites, as operators no doubt understand after spending the last decade transitioning their central offices into what effectively are data centers at the core of their networks. 5G infrastructure will be a hybrid of traditional telecom and IT infrastructure models, requiring seamless transitions between all systems at all times.

Source

techblog.comsoc.org

Understanding 5G Architecture

5G networks will be far denser than existing 3G and 4G networks in order to deliver on the dual promises of increased bandwidth and lower latency. That means there will be far more cell sites across the network and each site will feature more IT equipment. These are significant differences. Operators aren’t just adding to their existing networks; they are building new networks on top of those 3G and 4G architectures.

These differences manifest in various ways. The addition of IT equipment across the network requires greater attention to environmental protection of those sensitive electronics. That means hardened cabinets and enclosures and dedicated cooling and humidity control. Precision cooling typically was unnecessary in all but the most extreme climates in traditional telecom networks as those networks – including 3G and 4G iterations – required minimal IT equipment in the access space. Not so with 5G.

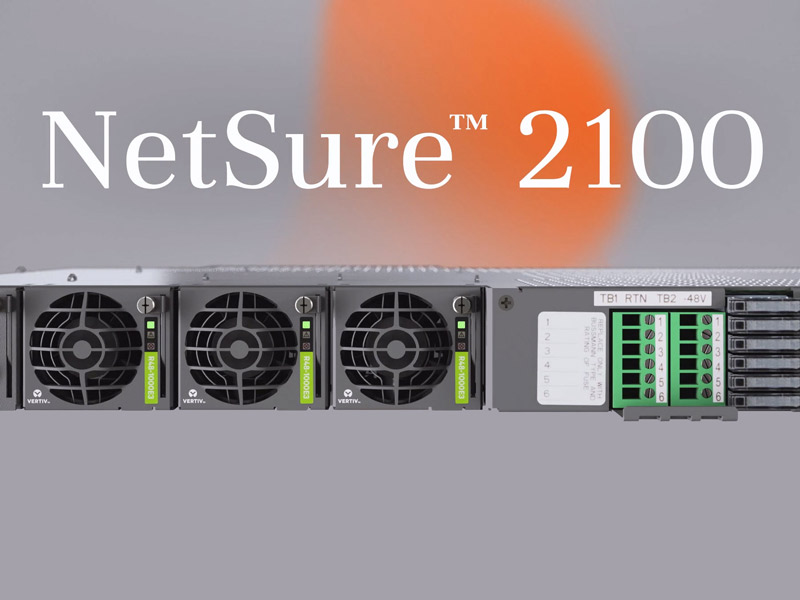

The widespread introduction of IT systems across the network introduces another complication. IT equipment requires a lot more energy to run and therefore typically operates on AC Power, whereas existing telecom networks and equipment rely on DC power. Additionally, alternative energy sources are used to supplement network power in many parts of the world, and those sources also produce DC power. This divide can be bridged, but it requires the right partner. Vertiv has deep, unique expertise in both the IT and telecom spaces that can help operators navigate what can be unfamiliar power architectures.

This addition of IT and introduction of AC power has been happening in central offices for several years and continues today. The access space is the new frontier of 5G with cell tower sites undergoing significant changes or upgrades to support 5G and these new IT resources. These sites have cycled through multiple architectures, from RAN to D-RAN to C-RAN toward what ultimately will be Cloud-RAN, or basically a virtualized cellular network that shifts loads seamlessly across sites and geographies.

These architectures have evolved to support the demands of the network, moving equipment from the ground to the tower and from the base of the tower to centralized hubs based on bandwidth and latency requirements.

The early macro base station with radio access network (RAN) architecture consisted of a cell tower and antenna with all associated equipment at the base of the tower connected to the antenna via coaxial cable. These types of sites required multiple enclosures or sometimes larger shelters housing all the required equipment.

Distributed radio access network (D-RAN) moved the remote radio heads (RRHs) from the base of the tower to the top of the tower alongside the antenna and replaced the coaxial cable with fiber. The rest of the equipment remained at the base. D-RAN reduced the power required, and increased network capacity, by reducing the distance between the antenna and the radio (reducing signal loss). The use of RRHs on the tower also meant a smaller equipment footprint at the base of the tower.

The more recent move to centralized radio access network (C-RAN) has been more disruptive. C-RAN architectures emerged to support 4G and took equipment from the base of the tower and centralized it elsewhere to serve multiple sites. This reduced the physical footprint at the tower and provided other benefits related to equipment monitoring and service. Many current 4G sites employ C-RAN architectures, but the move to 5G requires another re-evaluation of cell site design.

Again, the promise of 5G is based on the ability of operators to place computing as close to the consumer as possible, starting where they already have access to real estate – at cell tower sites. C-RAN has been removing computing equipment from those sites. We’re not going to see an immediate reversal – those centralized C-RAN sites will play a role in 5G – but we will see more IT equipment returning to those tower sites, the introduction of the open radio access network (O-RAN), and a brand new set of deployment challenges.

5G Deployment at the Core

There is a tendency to think about 5G as it applies to existing cell tower sites, and that certainly is one front in the ongoing global deployment campaign. In reality, however, 5G deployment is happening in central offices, in greenfield cell sites, and in IT deployments at the edge of the network. 5G networks are far denser and more complex than previous generations, and deployment is every bit the challenge that suggests.

In the central office, that means retrofitting existing facilities to support the IT servers required for 5G traffic. Traditional central offices were switching centers running exclusively on DC power and with a heat load of 2-3 kW that required little attention to cooling. 5G is changing everything. Those copper cables and line switches are out, replaced with racks of servers, additional DC power systems and/or AC UPS systems, and precision cooling units to manage the corresponding heat load.

These have been fundamental differences between telecommunications and IT architectures for decades. Telco relies on DC power to run the network and requires minimal cooling. Data centers and IT facilities use AC power to run servers, and the electronics in those servers are more sensitive to heat and require more sophisticated cooling to function properly.

With 5G, those lines are blurring. More IT equipment is being introduced into traditional telco environments, completely changing the power and cooling profiles for those facilities. In most cases, it’s not as simple as either AC or DC power. These facilities are evolving to include both, and that requires a special expertise to install safely and manage effectively. Vertiv, with decades of experience in both telecom and data center infrastructure support, has solutions for both AC and DC environments and is equally adept with both architectures.

For at least 20 years, the data center industry has been exploring the use of high-voltage DC power as an alternative power architecture in those facilities. The argument is simple: it reduces a power conversion, making it more efficient. The experiment has remained largely theoretical, although there have been isolated data centers and numerous pilot projects that have used high-voltage DC architectures. Ultimately, the unfamiliarity with DC and the reality that most servers remain AC-powered have precluded widespread adoption.

That approach is among those gaining some traction in these new IT-heavy, 5G telco central offices. These are facilities already equipped for DC power and run by decision-makers comfortable with DC. The inertia for the status quo that exists in the data center is absent in telecommunications.

Other operators are transitioning more or less fully to a data center-like AC power architecture, all but abandoning the DC roots of their central offices. In these cases, these facilities are fully conditioned, removing most of the equipment from the old central office and often replacing it with fully integrated, often prefabricated, modular IT solutions, such as the Vertiv SmartRow or SmartAisle.

The most common approach is a blend, still leveraging DC power systems for some elements of the facility while adding AC UPS systems for backup power to the servers. One trend emerging in all cases: the introduction of precision cooling. This is necessary to cool the IT equipment, but it adds additional equipment to the power load. This is one reason why, even though 5G is more efficient than 4G on a per-gigabyte basis, overall energy consumption will be much higher with 5G.

SmartRow and SmartAisle, although originally designed for data center environments, can be configured to support these blended AC/DC environments, although those AC and DC pods most often are separated for safety. In central offices, SmartRow and SmartAisle typically are deployed with 10-20 racks and incorporate hot- or cold-aisle containment for energy efficiency.

5G Deployment at the Edge

Supplementing this traditional core/access model is an emerging edge of the network that is necessary to support 5G. These edge resources add additional computing closer to the end user, which is necessary to enable the low-latency, high-bandwidth applications made possible by 5G. These resources can be deployed at tower sites or elsewhere in the access space.

The proliferation of the edge has been happening on the data center front for several years, and now telecom operators are deploying their own edge computing resources and, in some cases, leveraging existing edge computing/cloud providers to meet their 5G needs.

These edge data centers are sophisticated and critical to delivering full 5G functionality. The Vertiv™ SmartMod™ is a modular solution to this need, typically deployed as a 100 kW data center, with up to 10 racks at 10 kW per rack. The SmartMod features separate rooms for IT equipment and power systems and batteries and includes thermal management for all systems.

If it sounds like 5G requires expertise beyond what has been required of telcos in the past, that’s because it does. These 5G networks are a hybrid of telco and data center resources, blending AC and DC equipment and architectures in ways unfamiliar to most operators. Expertise in both arenas is critical to optimize 5G deployment.

Vertiv is singular in its knowledge and experience in both data center and telecom equipment and architectures. We are supporting these converging industries with unmatched expertise and seamlessly integrated solutions, removing these unfamiliar obstacles for operators with no time for a learning curve.

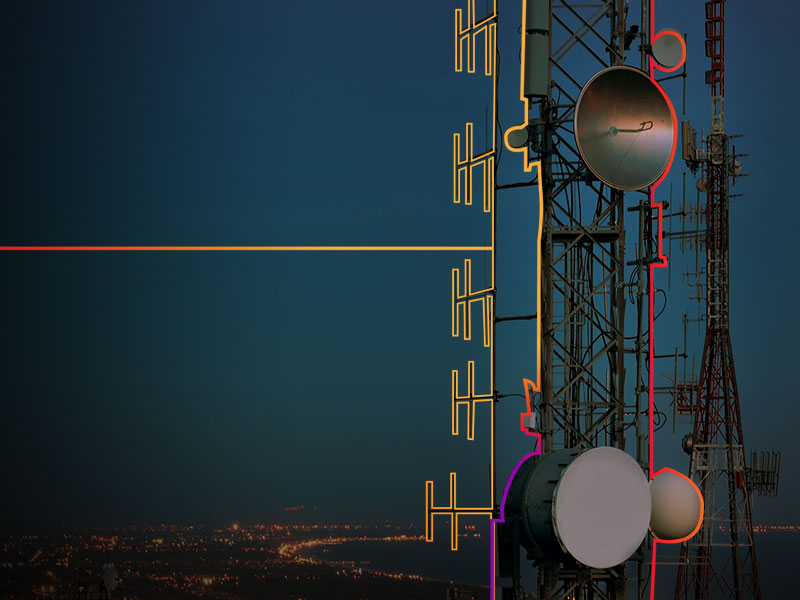

5G Deployment in the Access Space

5G is forcing changes to the access network that are nearly as drastic as those seen in the central office. The base stations at cell tower sites support a load of about 5 kW at a standard 3G or 4G site. With 5G, those loads are 20-40 kW. That sort of massive increase in power and computing requires significant upgrades to existing sites.

Managing the limited real estate at these sites is the first consideration, and that was one driver for moving radios to the tops of cell towers, and those towers now can hold dozens of radios. In some cases, rectifiers are placed on the towers as well, allowing the operator to run AC power up the tower, which provides cost savings because AC cable is less expensive than DC cable.

All of this introduces other complications, including power drops from the power systems at the base of the tower to the radios at the top. Voltage boosters can overcome those drops, boosting 48V to 57V to ensure sufficient power reaches the equipment on the tower. Vertiv accomplishes this with a creative solution, the eSure Power Extend Converter, which plugs into an existing DC distribution panel to conserve space at the base of the tower.

The additional equipment at these sites, specifically the IT equipment to enable 5G applications, requires new thinking about storage, security, and environmental control. Again, IT equipment is more sensitive than traditional telecom equipment, and it must be stored appropriately at tower sites.

This can be handled in different ways, from separate, smaller cabinets to larger enclosures that can house server racks and thermal management systems. The choice is determined by various factors, including the size of the site, the amount of equipment needed at the base, and standard environmental conditions.

As with the central office, the introduction of AC power into these sites can lead to other complications. Often the AC mains need to be upgraded or managed through software to support the increased AC load supporting the IT equipment. This software keeps the AC site breaker from tripping during peak hours by transitioning off the rectifiers and onto batteries.

Vertiv takes an innovative approach to this challenge, using three-phase balancing to keep from tripping the breaker. This sort of intelligent energy management is critical, because bringing in a new AC main from the utility can be both time-consuming and costly.

5G Progress Around the World

5G may be a global technology, but deployment is not happening at the same pace or in the same way around the world. China and South Korea sprinted out ahead in the race to 5G, pulling the rest of the Asia Pacific region with them.

Operators in that part of the world have been faster to deploy new networks and network equipment, performing site upgrades as needed and as a complement to an aggressive rollout of new sites. They also have been more open to high-voltage DC architectures, which is unsurprising considering many of the adopters of that technology in the data center were located in the region.

The strategy in the U.S. has been slightly more conservative than what has happened in Asia, with site upgrades from 4G to 5G playing an important role. There have been differences across providers, with the largest operators choosing to deploy to meet current and future needs and smaller operators opting for smaller deployments to minimize capital investment.

The surprising outlier is Europe, where 5G rollouts lag Asia and the U.S. by about a year. There are a number of ongoing issues, starting with continued delays in assigning frequencies on the spectrum.

There are some notable exceptions – France and Finland moved early and received spectrum assignments quickly – but in most cases auctions for space on the spectrum haven’t happened yet. The expectation is that some 70-80% of those assignments could happen by the end of 2021.

The sluggish start should not be mistaken for a lack of activity in Europe. The early movers are progressing at a brisk pace, and even operators still waiting for those spectrum auctions are heavily engaged in site prep so they can move quickly when the time comes.

Many European operators are selling their cell towers back to tower companies to raise the capital needed for 5G investment. Then they are turning around and leasing the use of those towers from the tower companies.

This is creating a need for intelligent power management at those sites, so operators are charged only for the time use at a given tower. Vertiv has power metering and management solutions for these multi-tenant arrangements.

Europe also has regulations around the number of cell towers that can be deployed, so the densification of the 5G network there is happening in different ways. To overcome the lack of towers, operators deploy a lot of overlapping small cells. These overlapping designs allow operators to deploy some sites without backup power, opting instead to shift loads to an overlapping site.

One surprising issue in Europe: ensuring 5G networks can support voice communications. Some 4G networks in the region are not equipped to support voice calls and instead rely on legacy 2G and 3G networks. The early indication, however, is that many operators plan to decommission those 3G sites and keep the older 2G for voice transmissions.

The slower rollout across Europe has afforded operators time to focus more on the energy consumption, emissions, and overall environmental impact of their networks. These issues are prioritized across the continent regardless of energy, but telcos there are aware of the issues inherent in 5G.

European telcos have long embraced hybrid power systems and are expected to continue to do so to support 5G and minimize the carbon footprint of those networks.

As expected, investment and progress in the Middle East and Africa has been centered in wealthier countries and urban centers.

5G Efficiency and Sustainability

|

5G will be the most transformative communications technology in a generation and enable a universe of new services, including advanced energy management capabilities that will be critical to solving growing energy and sustainability challenges. However, practical challenges remain for telecommunications operators facing spikes in energy consumption and emissions due to 5G. Even though 5G networks are up to 90% more efficient than their 4G predecessors, they still require far more energy due to increased network density, heavy reliance on IT systems, increased network use, and accelerated traffic growth. Operators must address these challenges by adopting energy efficient best practices across their networks that can help mitigate increasing energy consumption and emissions, and associated costs. |

|

As is true with everything related to 5G, these practices are new and unfamiliar and fundamentally different than anything that has come before. A fully realized 5G network requires more sites at the edge and is far denser than its 3G and 4G predecessors – massive changes that are necessary to support 5G frequencies and meet bandwidth and latency demands of 5G-enabled applications and their users. The cell sites themselves are different, with far more IT equipment that consumes much more energy. There has been a tendency across the industry – and certainly in the early coverage of 5G – to focus on the fact that 5G networks will be more efficient on a per-gigabyte basis than 3G or 4G. This is certainly true, but the massive increase in the number of sites and the energy demands of those IT-reliant sites will result in a corresponding spike in energy consumption. This spike will be significant. Global mobile data traffic will grow almost fourfold by 2025, leading to an overall increase in network energy consumption of 150-170% by 2026. Telecom operators know this as 94% anticipate an increase in energy consumption with the rollout of 5G networks. However, deploying quickly has been the priority in the early days of 5G. Now, as those networks expand and adoption becomes more widespread, operators are turning their attention to the energy use and costs of operating these networks. |

|

This isn’t a new consideration. After all, 92% of network operating costs are spent on energy consumption. 5G is merely amplifying the issue. There are a variety of strategies and tactics to consider, ranging from modest steps operators should be implementing already, to more ambitious approaches requiring a fundamental rethinking of site architectures. 5G networks require many new cell sites to adequately increase network density, but hundreds of thousands of existing sites around the world are undergoing 5G retrofits. Many, if not most, of those sites are equipped with older, inefficient equipment, and replacing legacy DC power systems with newer systems having high-efficiency rectifiers can improve efficiency by 5-6%. Of course, any new sites should prioritize efficiency and be configured with high-efficiency equipment whenever possible. Today’s DC power systems are more intelligent and capable of more advanced energy management – features that have been largely ignored in favor of static operation at traditional cell sites. Operators can reduce costs by leveraging these capabilities. For example, telecom operators can select operating modes that allow them to store cheaper, off-peak energy for use during peak hours to reduce on-peak utility draws and costs. |

|

Technological advances in batteries present additional opportunities for efficiency improvements. Lithium-ion (Li-ion) batteries offer several benefits over traditional valve-regulated lead-acid (VRLA) batteries with a falling price point that makes the return on investment more than acceptable. Because Li-ion batteries are smaller and can operate at higher temperatures, they do not require the same level of cooling as VRLA, reducing energy use and costs. Li-ion batteries last longer than VRLA, and by extending the life of the batteries, operators reduce monitoring and replacement needs, truck rolls, and costs – along with the carbon dioxide (CO2) emissions associated with those activities. Today’s DC power systems are more intelligent and capable of more advanced energy management – features that have been largely ignored in favor of static operation at traditional cell sites. Operators can reduce costs by leveraging these capabilities. For example, telecom operators can select operating modes that allow them to store cheaper, off-peak energy for use during peak hours to reduce on-peak utility draws and costs. Additionally, Li-ion batteries with intelligent battery management systems contribute to a comprehensive network energy strategy by enabling peak shaving, boosting conversion, and allowing above-capacity power system operation. These are important and immediate opportunities for efficiency improvements. Consider in 2019: 66% of telcos were in the process of upgrading their batteries and 81% said they would do so within five years. |

|

Incremental improvements, while important, will not be sufficient to manage the 5G energy challenge. At its core, the promise of 5G is the ability to process data and perform computing at each site and microsite to enable ultra-low-latency applications for the end user. To make that happen, operators must introduce IT equipment across their vast, growing networks. This is the most significant difference between 4G and 5G. Unfortunately, that IT equipment is designed for secure, climate-controlled data centers and not the rough and tumble world of the telecom access network. As discussed earlier, it is also designed to run on AC power. Introducing AC-powered equipment into these telecom environments adds a power conversion step, and every extra conversion results in an energy drop. That means you have to start with more power to accomplish the same result. More power means more heat, and IT equipment is more sensitive to heat than traditional telco equipment, which means cooling becomes more of a priority. Cooling consumes energy. |

|

Placing this equipment in the 40-foot concrete shelters common to many cell sites means those shelters must be cooled. Cooling those big, concrete structures – even when operating the IT systems at the upper limits of their thermal range – requires a lot of cold air and a lot of energy. Smaller, modern enclosures are designed to protect sensitive equipment from the elements and can be equipped with different types of cooling – from free outside air to liquid cooling technologies and everything in between – to meet the unique needs of any site, in any location. Intelligent management systems use artificial intelligence (AI) and data analytics to continuously calibrate optimal thermal settings, control pumps, and fans to achieve the best possible outcome. These are small issues for a single site, but these network sites can number in the hundreds of thousands. Even small increases in energy consumption add up quickly. Fortunately, so do small improvements. |

|

Energy consumption is just one piece of a larger sustainability challenge facing today’s telecom operators. The global focus on climate change and reducing emissions already is influencing industry decision-makers. Verizon and Vodafone are aiming for net zero emissions by 2040, and Telefónica has committed to net-zero in its top four operating markets by 2030. To get there, Verizon and Vodafone are targeting 50% reductions in electricity usage by 2025 and Telefónica a 70% reduction by 2030. These are bold promises, and the strategies to get there almost certainly will incorporate the aforementioned best practices. Those strategies alone, however, will not be sufficient. Renewable energy sources and hybrid power systems must be a part of the solution. Africa and Europe have been deploying hybrid systems for two decades, and other parts of the world are following suit. The United States has largely ignored hybrid technologies in the telco space as the cost and availability of energy remained low and the cost for solar panels and power was prohibitive. That is changing in parts of the U.S. with energy costs rising, availability becoming more precarious, and advances in solar technologies bringing the cost-per-kilowatt-hour closer to grid parity. For on-grid deployments, a solar add-on is a way of reducing reliance on the grid without having to increase infrastructure costs for better batteries. When available incentives are factored into the mix, are a solid recommendation. As the U.S. market for hybrid systems grows, investment will follow, which will spur innovation and drive down costs. |

Transitioning to 5G with Vertiv

Delivering exponential increases in the speed and volume of data transmission, 5G networks will open the doors to countless new, advanced, and increasingly valuable applications across all walks of life. As we come to rely on these applications, the reliability and security of the network becomes even more critical.

This presents an unprecedented challenge for today’s telecom operators, who must upgrade hundreds of thousands of existing sites, build just as many new sites, and manage the massive spike in energy consumption that will come with the proliferation of IT systems across the network.

That widespread introduction of IT in the telecom space is the central issue in terms of powering and protecting these 5G networks. Adding IT in the core, access and at the edge means adding AC power in traditionally DC-powered environments, and that is a foreign concept to most telcos. Their expertise in DC power goes back more than a century, but AC is new, different and adds a complication they can’t ignore.

The model emerging is something of a hybrid of traditional telco and data center architectures. Vertiv, with unique expertise across both industries, is working with operators around the world to deploy infrastructure solutions that support these sometimes-opposing interests and ensure their 5G networks operate reliably and efficiently.